नितिन गडकरी ने 6000 करोड़ रुपए से तैयार आउटर रिंग रोड के डीपीआर को मंजूरी प्रदान कर दी। यह आउटर रिंग रोड वर्तमान रिंग रोड से 12 किमी दूरी पर बनेगा। जिसकी कुल लंबाई 190 किमी की होगी। इसका प्रस्ताव रांची के भविष्य को देखते हुए किया जाएगा। यह रिंग रोड भविष्य में रांची के सभी प्रखंड एवं गांवों को टच करेगा।

इससे शहर और गांवों की दूरी कम होगी। इससे राज्य के अंदर गुजरने वाली तीन नेशनल हाईवे जुड़ेगा। जिसमें उरकिल एनएच-20, ब्रांबे एनएच-75, नगड़ी कुरगी एनएच 20 एनएच 43 और एनएच 33 इससे जुड़ेगा। एनएच-33 पर ओरमांझी प्रखंड कार्यालय के पास से होते रांची-कुड़ मार्ग पर नांवे में जाकर मिलेगा। एनएच-23 रांची-गुमला रोड से मौजूदा रिंग रोड से 8-10 किमी आगे जाकर आउटर रिंग रोड का प्रस्ताव है। तुपुदाना से आगे खूंटी से थोड़ा पहले निकल सकता है। 30 वर्षों के परिवहन लोड को ध्यान में रखकर इसको तैयार किया जा रहा है।

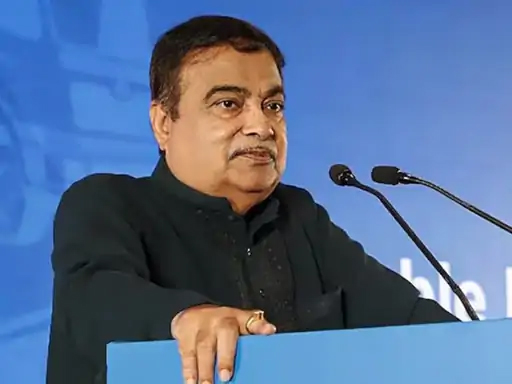

केंद्रीय परिवहन एवं राजमार्ग मंत्री नितिन गडकरी ने गुरुवार को झारखंड को 6300 करोड़ रुपए की सौगात दी। उन्होंने रातू रोड एलिवेटेड कॉरिडोर सहित 11 परियोजनाओं का उद्घाटन और शिलान्यास किया। इसके साथ ही रांची में तीसरा फ्लाईओवर आम लोगों के लिए खुल गया। अब शहर के लोगों को जाम से बड़ी राहत मिलेगी।

ओटीसी ग्राउंड में आयोजित समारोह में उन्होंने केंद्रीय रक्षा राज्य मंत्री संजय सेठ की चार मांगों में से तीन को मंजूरी दी। गडकरी ने कहा कि रांची में 6000 करोड़ रु. की लागत से आउटर रिंग रोड बनेगा। उन्होंने मंच से ही इसके डीपीआर को मंजूरी दे दी। रांची में इलेक्ट्रिक बस चलाने की बात भी कही। एलिवेटेड कॉरिडोर के पिलरों पर सोहराई पेंटिंग की मांग पर कहा कि कला केंद्र के कलाकारों के माध्यम से प्रस्ताव भेजें। इसे मंजूरी दी जाएगी। वहीं रांची-अनगड़ा-सिल्ली-मुरी सड़क पर कहा कि यह नेशनल हाइवे के तहत नहीं आता। इसके बारे में पता करके बताएंगे। केंद्रीय मंत्री ने कहा कि झारखंड में दो लाख करोड़ की परियोजनाएं चल रही हैं। एक लाख करोड़ की परियोजनाएं और जोड़ी जाएंगी।

इससे पहले गढ़वा में उन्होंने कहा कि झारखंड में 40 हजार करोड़ रुपए की राष्ट्रीय राजमार्ग परियोजनाएं पूरी हो चुकी हैं। 70 हजार करोड़ की परियोजनाएं चल रही हैं। वहीं 75 हजार करोड़ की योजनाएं प्रस्तावित हैं। -शेष पेज 13 पर

मौसम खराब, ढाई घंटे देरी से गढ़वा से रांची पहुंचे

नितिन गडकरी को दोपहर 2:30 बजे गढ़वा से रांची पहुंचना था। लेकिन गढ़वा में कार्यक्रम के दौरान मौसम खराब हो गया। रांची एयरपोर्ट के एटीसी ने हेलीकॉप्टर के उड़ान की अनुमति नहीं दी। इसके बाद वे गया चले गए। फिर उन्हें लाने के लिए रांची से चार्टर्ड विमान गया भेजा गया। इससे वे शाम करीब पांच बजे रांची पहुंचे। इस कारण यहां एनएचएआई के अधिकारियों के साथ होने वाली बैठक स्थगित कर दी गई।

इन परियोजनाओं को भी दी मंजूरी…

एकचारी से महगामा फोरलेन सड़क बनेगी। 1300 करोड़ खर्च होंगे।

कोडरमा-मेघातारी फोरलेन सड़क को मंजूरी, 900 करोड़ की लागत आएगी।

पाकुड शहर में 450 करोड़ की लागत से 20 किलोमीटर लंबा बाईपास बनाया जाएगा।

हंटरगंज में 150 करोड़ की लागत से 7 किलोमीटर लंबा बाईपास बनाने को भी मंजूरी दी गई।

भास्कर: गुरुजी के स्वास्थ्य का हवाला देकर सीएम ने डेट बढ़ाने का आग्रह किया था?

रातू रोड एलिवेटेड कॉरिडोर के उद्घाटन की तिथि पर विवाद चल रहा था। इस पर भास्कर के विशेष संवाददाता विनय चतुर्वेदी ने नितिन गडकरी से बात की। पूछा कि सीएम ने गुरुजी के स्वास्थ्य का हवाला देकर उद्घाटन की तिथि बढ़ाने का आग्रह किया था। पर ऐसा नहीं हुआ। इस पर गडकरी ने कहा-हेमंत से बात हो चुकी है। उनकी सहमति के बाद ही उद्घाटन हुआ है। वे दिल्ली पहुंचते ही गुरुजी से मिलेंगे। पेश है बातचीत के अंश…

गडकरी: हेमंत से बात हो गई है, वे सहमत हैं, मैं गुरुजी को देखने अस्पताल जाऊंगा

झारखंड को सबसे अहम सौगात क्या दे रहे हैं?

-आज मैंने झारखंड के संदर्भ में कई घोषणाएं की हैं, पर इसमें रांची-जमशेदपुर को एक अहम सौगात दे रहा हूं। नागपुर की तर्ज पर रांची और जमशेदपुर में ई-बस का परिचालन करवाएंगे। रांची और जमशेदपुर के बीच भी ई-बस चलेगी। इसके लिए सर्वे का निर्देश दिया गया है।

आज एलिवेटेड कॉरिडोर का उद्घाटन किया। इसी सड़क पर रांची से कुड़ू तक फोरलेन की राइडिंग क्वालिटी पर कई बार सवाल उठे हैं। क्या कहेंगे?

-पता करता हूं। ऐसा है तो ठीक किया जाएगा।

टोल व्यवस्था पर आपके विभाग ने कई पहल की है। पर यह हमेशा विवाद में आ जाता है। आम लोग भी टोल व्यवस्था पर सवाल उठते रहते हैं?

-इसकी चिंता करके ही नई व्यवस्था बनाई गई है। अब तीन हजार रुपए में एक वर्ष तक आप 200 बार यात्रा कर सकते हैं। इसका आम लोगों को काफी लाभ होगा। -शेष पेज 13 पर

रांची और गढ़वा से इन 11 योजनाओं का किया लोकार्पण-शिलान्यास

गढ़वा में शंखा से खजूरी तक 23 किलोमीटर लंबा फोरलेन बाईपास।

रांची में 4.17 किलोमीटर लंबी रातू रोड एलिवेटेड कॉरिडोर।

पलमा से गुमला तक 63 किमी लंबी फोरलेन सड़क। {बाराहाट से तुलसीपुर तक 15 किमी 2 लेन पेव्ड शोल्डर का चौड़ीकरण।

बरही से कोडरमा के बीच 28 किमी फोरलेन सड़क। {गोड्डा से संुदरपहाड़ी तक 18 किमी 2 लेन पेव्ड शोल्डर का चौड़ीकरण।

गिरिडीह शहर में 9 किमी सड़क का चौड़ीकरण

इनका शिलान्यास

छत्तीसगढ़ सीमा से गुमला तक 32 किलोमीटर फोरलेन सड़क।

सिमडेगा जिले में 8 हाई लेवल ब्रिज का निर्माण।{दामोदर नदी पर हाई लेवल पुल व भौरा रेलवे क्रॉसिंग पर आरओबी का निर्माण।

मुर्गाताल से मानपुर तक 27 किमी 2 लेन पेव्ड शोल्डर का चौड़ीकरण।

उद्घाटन की तिथि के विवाद पर गडकरी से भास्कर की खास बातचीत

रातू रोड एलिवेटेड कॉरिडोर आम लोगों के लिए खुला

रक्षा राज्यमंत्री संजय सेठ की चार में से तीन मांगें स्वीकृत

उद्घाटन के बाद केंद्रीय मंत्री नितिन गडकरी का काफिला रातू रोड एलिवेटेड कॉरिडोर से गुजरा और इसका जायजा लिया।